“It’s definitely the end of linear TV over the next five, 10 years, so very bullish on streaming,” said Reed Hastings, Netflix’s co-CEO, to JPMorgan’s Doug Anmuth, who moderated interviews after reporting Netflix’s Q2 financials on July 19, 2022.

Meanwhile, Netflix’s streaming service lost 970,000 subscribers in Q2, and more are expected. And this is after the streamer already lost 200,000 subscribers in Q1. Plus, Netflix stock, which closed at $201 a share on July 19, 2022, has dropped about 70 percent year-to-date.

At the same time, Disney reported a strong $9 billion Upfront, of which 60 percent is earmarked for its linear channels, including ABC. As it was written in a July 19, 2022 article published by online news service Axios Media Trends, “Traditional TV networks — although shrinking — are able to command higher rates, as they are the last remaining place advertisers can reach audiences at scale.”

And Disney isn’t the only network to have recorded high Upfronts. NBCUniversal, for example, brought in more than $7 billion this year, of which only $1 billion is going to its Peacock.

“Linear TV” is the new name of what was once known as “appointment television.” This is the opposite of “on demand” television, even though linear TV has on-demand features, which are described as “live +” for advertising purposes.

While these trends are developing, Morgan Stanley warned that a potential “streaming recession” could be on the horizon. “We are lowering net adds expectations across the board to reflect rising churn risk from consumers trimming their streaming portfolios in a more difficult economic environment,” Morgan Stanley analyst Benjamin Swinburne said in a note that the firm published on July 18, 2022.

So, considering the negative trends for streaming services, the financial losses that they’re experiencing (Netflix’s accumulated long-term debt reached $27.79 billion as of March 31, 2022, and is facing higher interest rates. Source: macrotrends.net), the economic downturn, and the increased competition for limited consumer resources, it would take a lot of chutzpah to predict the end of linear TV in five years, when even the streamers are betting on linear TV for their sports and live events offerings.

Finally, Shelly Palmer, a professor of Advanced Media in Residence at the S. I. Newhouse School of Public Communications at Syracuse University, delved into the argument, explaining that to understand the linear TV landscape future, one must “study the radio business. It suffered TV’s ‘ultimate fate’ a while back, yet — against all odds — it’s still a $10 billion annual business. Why? Because it’s free to use.” And, let’s not forget that the most successful shows on streaming services are broadcast’s off-net TV series.

Under these developing trends, one could more easily expect the end (via merger or acquisition) of Netflix in the next five years, if not sooner.

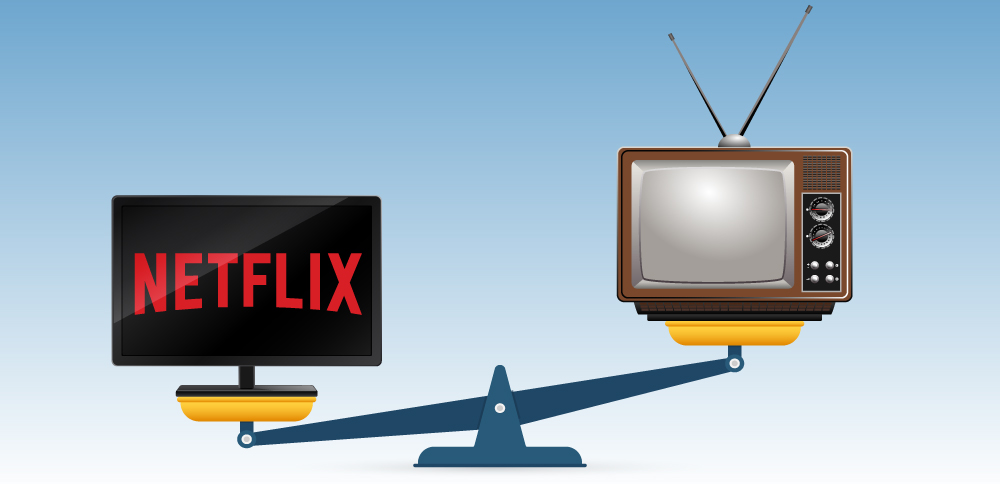

If one wonders about the veiled meaning of the above picture, the clear message is that streaming (as exemplified by Netflix) has “weight,” but linear TV is still on top.

[…] The End of Linear, or the End of Netflix? videoageinternational.net Source link […]