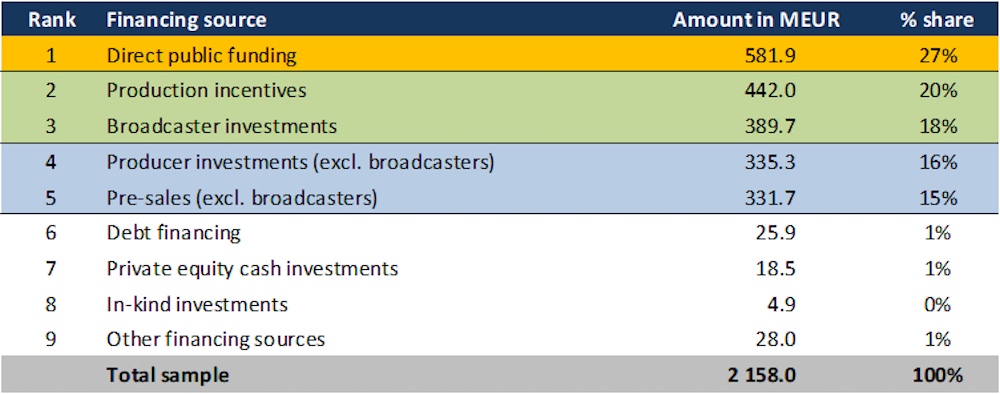

In 2022 — the latest year for available figures for European theatrical fiction films — financing continues to be based primarily on five different financing sources: direct public funding, production incentives, broadcaster investments, producer investments, and pre-sales.

Direct public funding remains the single most important financing source of European theatrical fiction films, contributing 27 percent of the total financing volume. Production incentives, for the second year in a row, remains the second most important financing source, accounting for 20 percent of total financing volume. This report was released by the European Audiovisual Observatory (EAO), part of the Council of Europe in Strasbourg, France, to provide data and analysis on the entertainment sector. According to the EAO report, based on the actual budget analysis of 713 European live-action fiction films, in 2022, the median average budget of a European theatrical live-action fiction film was 2.19 million euro (U.S.$2.39 million).

According to the EAO chart (shown above), broadcaster investments accounted for 18 percent of total financing, slightly ahead of producer investments and pre-sales, which accounted for 16 percent and 15 percent of total financing, respectively (which amounted to 2.158 billion euro or U.S.$2.35 billion).

However, there are structural differences in various countries regarding how theatrical fiction films are financed. Some of these differences are linked to market size. The EAO data indicates that direct public funding in film financing decreases with increasing market size and vice versa. While comprising only 19 percent of total financing in the four large sample markets, direct public funding accounted for 46 percent in medium-sized and 58 percent in small sample markets.

In contrast, the financing of production incentives increases with market size, increasing from only eight percent in small markets to 14 percent in medium-sized markets, and up to 23 percent in large markets. In addition, pre-sales are comparatively low in small and medium-sized markets when compared to large markets.

Leave A Comment