In the linear TV world, counting the “eyeballs” on any given show is relatively easy (although some viewers will always be missed, such as folks watching TV in places like bars, restaurants, or hospitals). In the digital TV realm, the task of counting viewers should be easier, and it indeed is when dealing with CPM or clicks. But it’s less easy when it concerns streaming services like SVoD. Unlike AVoD, SVoD services are not concerned with “cume” audiences, but sub numbers. And streamers are generally happy to show off their large number of subscribers to their investors (i.e., Wall Street).

Internally, however, the SVoD streamers also count the number of TVHH (that they refer to as “accounts”) that view their offerings in order to gauge what subs like to watch. These numbers are mainly used to determine how to get new subs, how to “steal” subs from other services, and how to reduce their own churn. But for all we know, that kind of info isn’t used for any particular purpose since a business model that would utilize those numbers doesn’t yet exist. In fact, all SVoD streamers currently navigate in the fog, and are operating at huge losses.

Due to the lack of this aforementioned business model, the streamers are adding ad-supported optional services that offer a proven business model based on CPMs.

But, in order to determine the CPMs, advertisers need to know the number of eyeballs reached, and here’s where those “internal” figures become important. They are called internal, but they became decidedly external in September 2021 at the Los Angeles–based Vox Media’s Code Conference when Netflix’s co-CEO Ted Sarandos

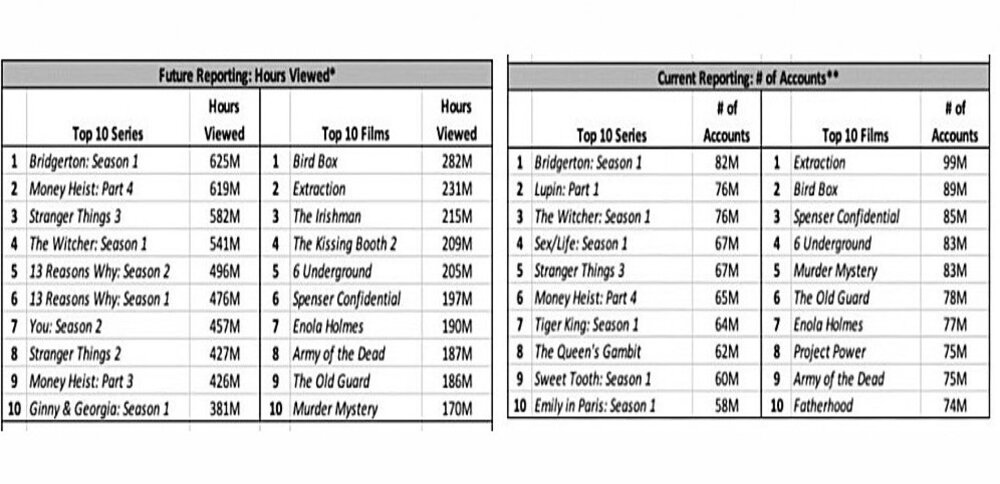

showed attendees both the streamer’s most popular programs based on the total hours viewed, as well as the total number of TVHH (accounts) that viewed the same shows (charts pictured above).

While the top shows’ list of total hours watched is posted on its website, the chart about total TVHH that watched the shows was something new and unexpected.

The charts also showed that there is no “constant” between the “Hours Viewed” and the number of “Accounts” that viewed the same shows. For example, Bridgerton was viewed for 625 million total hours by 82 million accounts, generating a “factor” of 7.6; Bird Box, with 282 million hours was viewed by 89 million accounts, with a 3.2 factor; and The Old Guard, with 186 million hours, had been viewed by 78 million accounts, or a 2.4 factor.

Netflix calls viewers who watch 70 percent of a given show “watchers,” subs who watch just two minutes “starters,” and subs who watch 90 percent “finishers.” The number of total hours refers to those shows that are watched for at least two minutes in their first 28 days on the service.

Naturally, for advertising purposes, the goal is to get a large number of accounts watching a show because it would be easier to determine potential revenues. For example, at $40 CPM, with a cume of 89 million accounts, Bird Box could be generating $3.5 million per 30-second spot. Netflix is reportedly allowing four minutes of commercial time per hour that are a maximum of 30 seconds each, with the ads sold by Microsoft (which is asking for a CPM of $65). For production purposes, however, it is important to know the hours viewed to gauge a show’s appeal, even though it is unknown how this could determine production costs.

Leave A Comment