Some of us in the media thought that Parrot Analytics was just a company from somewhere in the world that measures the popularity of television content around the globe.

“Not completely,” said Laurine Garaude during MIPCOM Cannes. “We’re much more than that.” Garaude joined Parrot in May 2022 (after she left Reed MIDEM, which then became RX France) with the title of Partnership Director, EMEA. This somewhat vague title is typical Parrot-speak. The company also likes to use rather arcane terminology in its reports, such as saying “genre preferences compared to the global average” instead of the simpler “audience content preferences.”

One way that Parrot Analytics has been repeatedly described online is as a company involved in the measurement of demand for television shows that includes social media engagement, video streaming and peer-to-peer protocols, photo sharing, blogging, and research platforms. That description is easy to understand. But descriptions of the company from its own website revert to Parrot-speak. For example, a report that explained how Parrot monetizes all the data that it collects, said: “Our data accelerates content sales and distribution, in-forms better acquisitions and programming decisions, facilitates cost-effective marketing, de-risks production, helps content strategy and recommendations, informs better merchandising deals, and more.”

There’s been a recent surge in analytics companies pitching their audience insights and content intelligence services, so much so that the sector is quickly getting saturated.

Among the most well-known names is Tubular, a subscription-based service that provides social video measurements and counts among its clients A+E Networks and PBS.

VideoAge, which at MIPCOM had its stand just around the corner from Parrot, was curious to find out what Garaude meant by “more,” and we asked her to answer a few questions via e-mail from her Paris office. “I did my research before joining the company, and I can assure you it is much more than you expect,” she said. She ultimately redirected any and all questions to Parrot’s PR department.

In anticipation of the official answers, and using VideoAge’s own data-mining resources, we learned that Parrot Analytics was co-founded in 2011 in New Zealand by Wared Seger, the company’s current CEO. However, finding out who the other co-founder(s) were, as well as other information about the company proved to be a challenge. Various online accounts list one Adel Shahin and Australian futurist Chris Riddell as co-founders. But these names have not been officially confirmed by anyone at the company. New Zealand entrepreneur Alan Gourdie is also listed as having been Parrot’s chairman from 2013 to 2017, as well as one of its lead investors.

Explained Gourdie from Auckland, New Zealand: “I was chairman for the first three years. In its first couple of years from 2011, Parrot started looking at using its data sources for use in the music industry before Wared pivoted the company to focus on TV/film.” In a subsequent e-mail, Gourdie stated that “I invested in the first two seed rounds Parrot launched, [but] due to its early success the company and the board needed more U.S. media industry expertise than I could provide and I was happy to open my seat up for a person with those credentials.”

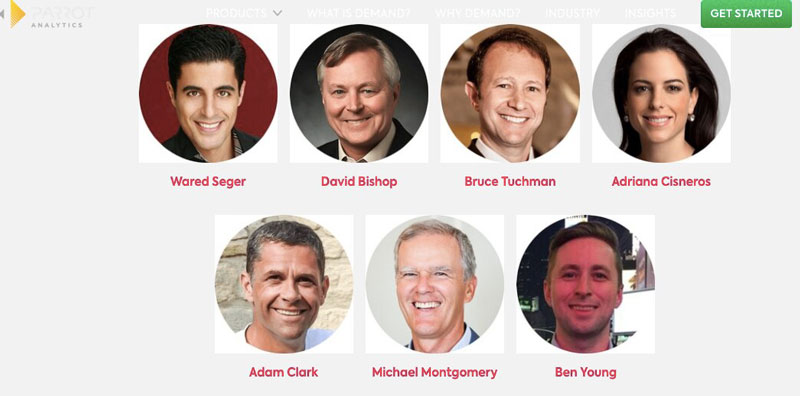

And indeed, seven executives sit on the current board (pictured above), including David Bishop (formerly of Sony Pictures Home Entertainment and MGM Home Entertainment), Bruce Tuchman (former president of AMC Global), and Adriana Cisneros, CEO of Grupo Cisneros, who sent a note to VideoAge, stating: “I’m on the [Parrot] board and excited about the impact we’re having on the entertainment industry globally.”

Now, it is known that Seger completed a Bachelor of Biomedical Science in neurobiology in 2009 at The University of Auckland, followed two years later by a Master of Bioscience Enterprise from the same institution. While at the university, he raised more than NZ$8 million (U.S.$4.8 million) in capital funding to develop a range of analytics products, including Demand Expressions, a data tool that allows acquisition, production, and marketing executives to gauge market interest in specific TV programs and genres in real time across all platforms. Demand had the backing from, among others, K1W1, owned by New Zealand investor Sir Stephen Tindall. These were aspects of The University of Auckland entrepreneurship ecosystem, which ultimately allowed Seger to launch Parrot Analytics, now a company with U.S.$18.5 million annual revenues and employing 66 people (source: Datanyze).

However, via e-mail, Seger stated that he wasn’t born in New Zealand (the University of Auckland did, however, report that he grew up in West Auckland), that he’s not 36 years old (as many assumed after learning that he graduated with a Bachelor’s degree in 2009), and that the information about Gourdie and Sir Stephen was inaccurate… but failed to provide the correct details. As for whether he ever moved to the U.S., he said: “We have offices in Los Angeles and New York, and I’m there often.” (Other offices are in Auckland, London, and São Paulo, while its headquarters is officially in West Hollywood, California.)

Similarly, Samuel Stadler, Parrot’s VP of Marketing, declined to divulge Seger’s age, birthplace, and the origins of the name Parrot, stating that “it’s not all that interesting.” (A 2020 article in The New York Times about Parrot Analytics indicated that Seger’s age was, at that time, 32).

In addition, there is very little non-promotional content about the company online, and Wikitia (a sort of Wikipedia) provides a lot of data, but not any insight into the company, which is ironic since during one of Seger’s many public appearances (in print, on YouTube, and as a guest on a variety of podcasts), he explained that “it’s not a question of having more data. There’s more data, but less insights, because big data and insights are not synonymous. You can have a lot of data, but very little insights.”

And in the case of Parrot, even the insight about the origin of its name is not entirely clear-cut. Omar Méndez, VideoAge’s LatAm contributor and editor of the Spanish-language The Daily Television, closely follows Parrot’s cascade of press releases. He assumes that “the name of the company corresponds to what it is. They record and process everything they hear and the surrounding noises, as do the birds that bear their name,” he said.

As for the company’s services, the widely available information seems to point to the fact that Parrot Analytics captures a spectrum of actual audience behavior, including video streaming consumption, social media, blogging platforms, file-sharing and peer-to-peer consumption. This, combined with artificial intelligence platforms, allows the company to provide insights into geographic-specific audience demand for content. This enables media companies to understand audience demand for content across all content distri-bution platforms in all markets around the world.

This kind of analytic ability has been reassuring for the broadcasting sector. In fact, a recent Parrot report stated: “To paraphrase a famous quote: the death of broadcast television has been grossly exaggerated. It’s true that the average viewership garnered by major broadcast networks in primetime has plummeted since 2015. Yet broadcast’s supposed demise remains more of a splashy narrative than concrete law. Fifteen of the 100 most in-demand TV series across all platforms year-to-date worldwide originated on broadcast networks. That number rises to 23 if we look at just the U.S., a signifier of how significant the cultural footprint of these shows can truly be, particularly in the highly competitive domestic market.”

Finally, in one of Seger’s podcast interviews he said: “We process a trillion data points a day, from 249 countries around the world. That’s every country on the planet.” He then proceeded to give some industry insight: “There are over 600 OTT platforms around the world, and U.S.$800 billion is spent on television content around the world. That’s everything from content investments, content production, distribution, mar-keting, and advertising. And it’s probably the least data-driven industry out there, given its size.”

He then concluded: “People think technology and science are synonymous — they are not — technology is the application of scientific research and it’s necessary to have entrepreneurship to commercialize the technology to the wider market. So that’s what science commercialization is. It’s a combination of those things.”

Ultimately, Parrot’s Stadler provided some insight into the “more” that Garaude alluded at the beginning of this article. “In terms of pricing, Parrot operates on a SaaS [Software as a Service] subscription model. At the same time, our teams work very closely with all of our customers, helping them to answer specific acquisition, programming, sales & distribution, financing, content valuation and strategy questions,” he said.

He added, “We [have] the ability to value, in dollar terms, how much a TV show or movie is worth to a platform.” This ability includes services like “platform-specific value contribution analysis for any TV show or movie,” plus “global market demand assessment of intellectual property,” and “IP and content development, financing, programming and acquisitions, sales and distribution,” which at one time in the U.S. were something that the major studios developed internally and were called “the Ultimates.”

(By Dom Serafini)

Audio Version (a DV Works service)

Leave A Comment