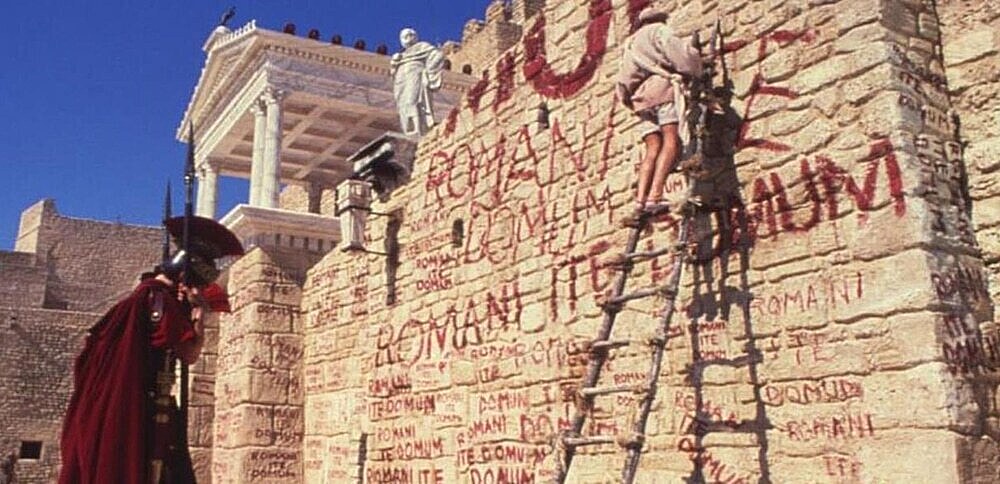

“Everyone writes on the walls, but me,” read graffiti in ancient Pompeii. We at the Water Cooler feel similarly these days in that it seems like everyone is writing about streaming services but us.

Streaming services are blamed for a host of studio layoffs, for the misfortunes faced by cinemas, for the challenges FTA broadcast television is encountering, and for data caps, which translate into more money for broadband services.

“The average number of streaming services bundled by consumers grew from five in April [2020] to seven in the second half of October,” boasted the New York City-based NPD research group, citing a study about average SVoD subscriptions per U.S. customer.

These figures contrast with those of media research group Kagan, which reported that U.S. households now subscribe to 3.1 streaming services on average, up from 2.7 last year.

On the other hand, in 2019, other researchers (like Harris Poll) were peddling the notion that U.S. consumers were willing to subscribe to an average of 3.6 streaming services.

Then The Wall Street Journal ran a piece in December, “Streaming Wars of 2020 Turned Into Feast,” which noted that market research firm MoffettNathanson reported that the eight main streaming services in the U.S. were Netflix (with a household penetration of 61 percent), Amazon’s Prime Video (47 percent), Disney’s Hulu (36 percent), Disney Plus (31 percent), HBO Max from Warner Bros. (15 percent), Apple TV Plus (11 percent), CBS All Access (now Paramount Plus, nine percent), and Peacock from NBCUni (seven percent). VideoAge calculated that these eight services have a cumulative 179 million subscribers, which averages to 1.5 services per household if spread among the 121 million total U.S. households. So if the average subscription level reaches the estimated (and rather conservative) figure of 3.1 per household, streaming services’ growth will really be exponential.

However, can Warner Bros., ViacomCBS, and NBCUni (the studios in the bottom tier in the above list) prosper if they base all of their corporate structures on the growth of their streaming services, even if their sub bases double?

Leave A Comment