Recently, JT TV-FILM International released a report analyzing the state of the market and comparing it to years past.

According to the report, a slight increase in advertising revenue in 2014 (+4.3 percent) was stopped due to new government policies and the ongoing economic uncertainty in the country.

The summer of 2015 was a difficult one for Greece, in fact, Greek banks closed for several weeks and government-led financial and business restrictions known as “capital controls” were enforced. The controls “had a negative effect on payment procedures in comparison to those used in the past and consequently most of the designated payment terms on the deals have been pushed back,” according to the report.

“The new procedure in dealing under the capital control has made issuing payment outside of Greece a very difficult process. A request for payment has to be submitted to the bank, along with a slew of various paperwork. This has to be reviewed, checked and approved and then taken to Ministry of Finance for final approval. Each bank has a limit on the amount of funds that can be transferred per month. Priority is still given to payments for perishable goods or materials or production (factories) , medical issues, student tuition fees etc. Last on the list is for entertainment etc.”

Many TV executives have had to freeze their plans, according to the report. “If and when the economic landscape will become clearer, then we are bound to see more entries in the television market, both in the foreign and local language productions.”

And at the beginning of 2016, the government introduced a bill that would cap the nationwide television licenses at four (there currently are five major private channels and a few other smaller stations). The matter is still up in the air.

In the meantime, here are the report’s main findings:

Station shares

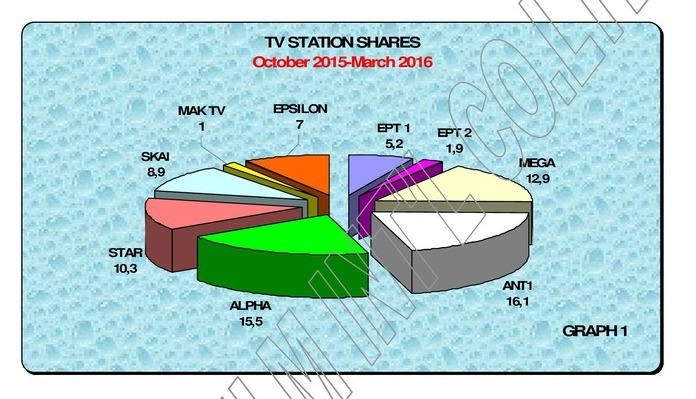

Despite seeing a slight decline in share from the same time last year, Antenna TV had the highest market share. Alpha and Mega followed narrowly behind, followed by Star and Skai (which both saw increases over the same time last year).

Antenna was able to deal with the crisis, according to the report, by reducing operating costs. The station’s schedule features a mixture of factual and fictional programming from its archive, along with some foreign acquisitions. The station once aired Europa League football games and Greek Basketball Cup matches, but no longer does.

TV vs. other forms of media

Greek audiences use the Internet more than television, and while TV consumption has decreased in the last five year, perhaps unsurprisingly, internet consumption has increased. After television, radio is the next most popular form of media.

Greek audiences between the ages of 18 and 44 spend an average of 138 minutes watching television each day, 148 minutes on the internet and 131 minutes listening to the radio.

TV advertising, and viewer information

There was a dramatic drop in local TV advertising in 2015.

Supermarkets represent the largest advertisers (based on time spent). There was a 19 percent increase between 2014 and 2015. The second largest advertisers are mobile companies, but those have decreased by 15 percent year over year.

Interestingly, women and people over 55 make up the largest share of TV viewers. In fact, Star is the only network for which a majority of viewers weren’t over 55.

Pay TV

Over the past six years, the saturation of pay-TV has increased from 11 percent to 24 percent of households. The number of subscribers exceeds one million. But the government recently announced that a tax levy will be imposed on subscription fees in the coming months

OTE TV is the corporate name for two pay-TV services in Greece, owned by Greek telco OTE. They include IPTV service OTE TV via broadband and satellite TV service OTE TV via satellite. And OTE TV has seen growth. As of December 31, 2015, total TV subscribers amount to 446,000, a nearly 10 percent increase in the quarter and almost 25 percent increase year over year. “Together with the rise in subscriber numbers, higher ARPU (up 26% in Q4’15) enabled OTE’s pay-TV operations to reach breakeven on a stand-alone basis. OTE continued to monetize the significant investments it is making in quality content, such as the European football UEFA Champions League, UEFA Europa League, UK Premier League and Greek Cup.” OTE also launched its own History Channel, the only documentary channel on Greek TV, focusing on the country’s history and culture.

Leave A Comment